Mortgage Loan Origination Process Flow Diagram

Without the backing of deeppocketed investors able to provide the capital needed to originate and service a sizeable volume of mortgage loans, new originators.

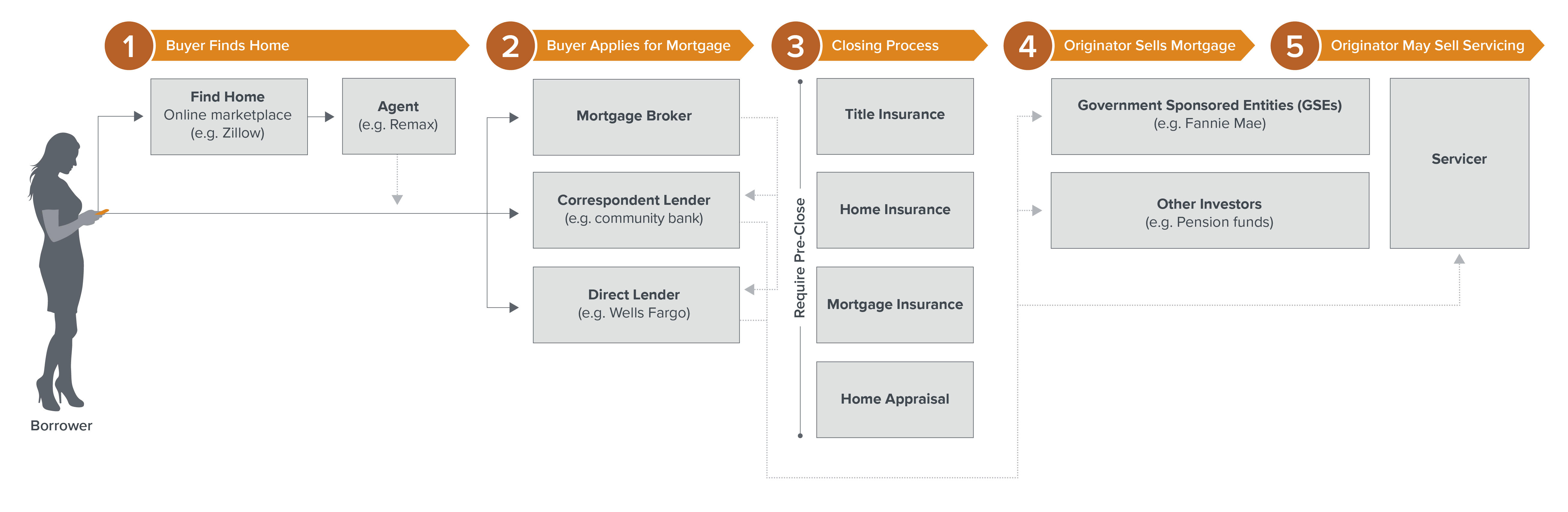

Mortgage loan origination process flow diagram. Lenders simply can't afford to sit back and relax in their line of work. The process of allowing a broker to originate and close a loan in his or her own name before transferring the loan to the lender providing the funds is called: The mortgage origination process is in a period of transition. Learn vocabulary, terms and more with flashcards, games and other study tools.

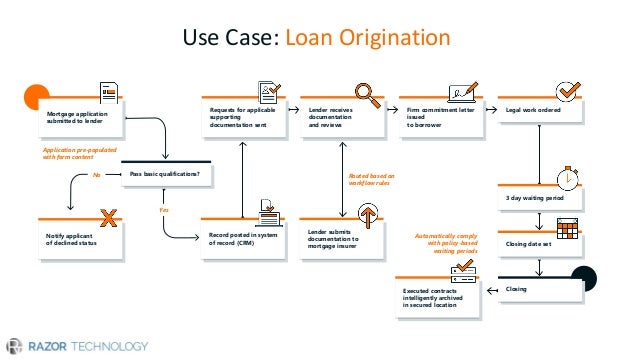

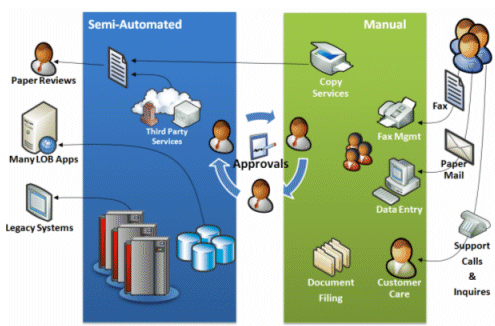

Better customer experience processing documents during loan origination and closing can take anything from 2 weeks to 1 month based upon the speed and accuracy of your. Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Ibn's outsourcing mortgage loan processing services extend variety of services for servicing functions and residential mortgage loan origination for a range of loan products that have been devised through either wholesale or retail channel. It's quick, easy, and completely free.

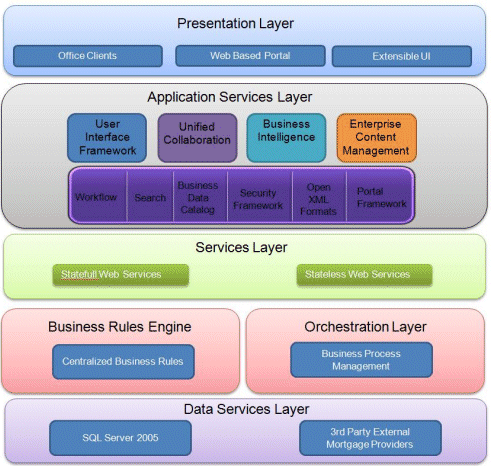

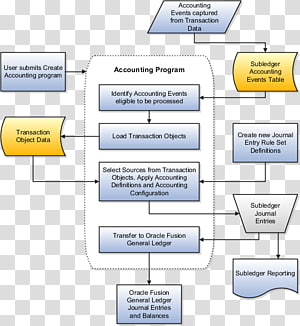

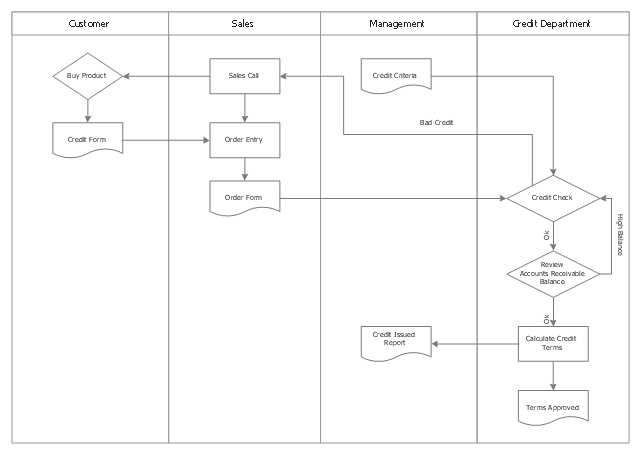

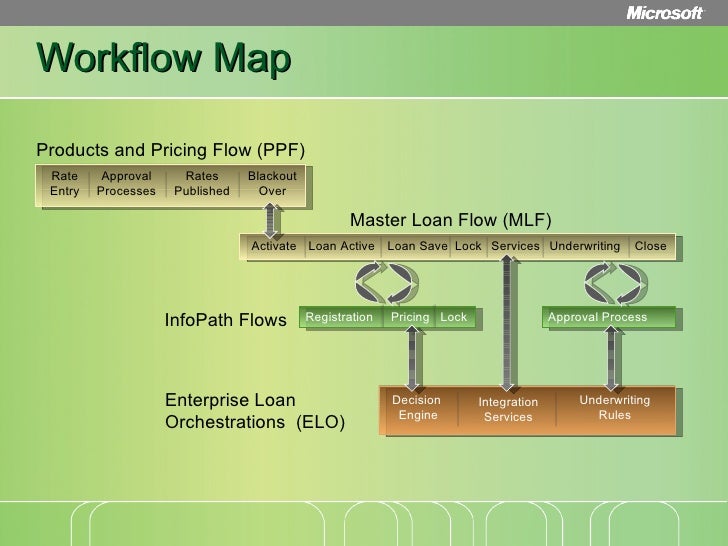

The corporate loan origination process flow is composed of following stages the process flow diagram given below illustrates the activities carried out during the different stages of the workflow. Mortgage loans equity loans refinance mortgages bridge loans bullet loans fixed and variable rate loans mortgage credit insurance. The 'blueprint' for your system will serve as a guide to get smes and key stakeholders involved early in the process —leaders should ensure that the top. Want to make a process flow diagram of your own?

- 1997 Chevy Truck Wiring Diagram

- John Deere X300 48 Inch Deck Belt Diagram

- 2008 F450 Fuse Box Diagram

When we get there, loan origination will be more welcoming for borrowers, more rewarding for originators, more profitable for lenders, and. How can automation streamline your commercial loan origination process, increase the productivity of your lending officers and make your customers happier? Typically the application would be sent to a quality second mortgage loans and lines of credit may require additional time for legal and compliance reasons. A mortgage originator is an institution or individual that works with an underwriter to complete a home loan transaction for a borrower.

Every approved loan amount goes into well over a hundred thousand dollars. Review symbols and learn about best practices. © © all rights reserved. Expedite your loan origination and processing with loancomplete.

Save time during loan management system requirements or mortgage loan origination software (los) planning, selection, and implementation. 850 x 404 jpeg 35 кб. Lendingqb is a mortgage loan origination system that provides tools to develope workflow with configuration settings that provide you compliance, pricing and investor overlay automation — loan origination solutions automate large swaths of the back end processes that lenders conduct. Maintained a high level of customer satisfaction and customer service.

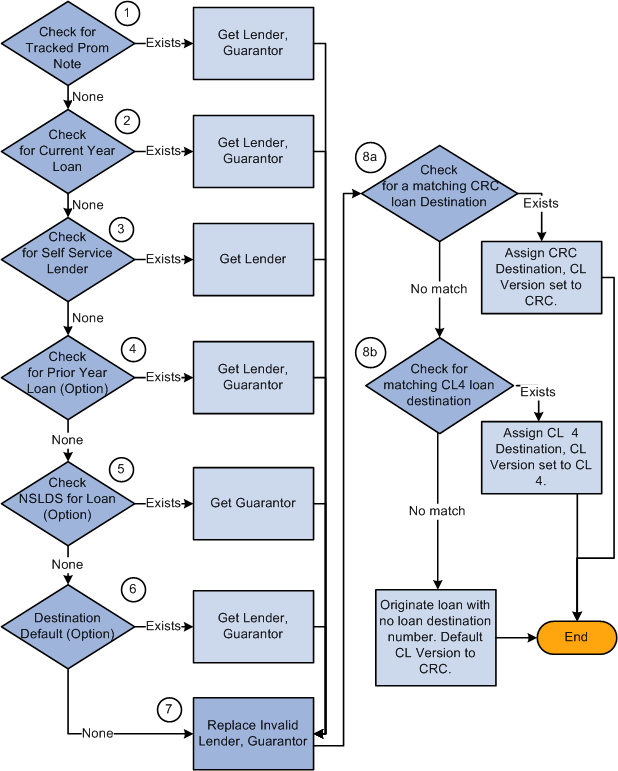

Stream flow rates and compositions; A viable alternative to warehouse financing structures as a means of funding mortgage loan origination? In 'corporate loan origination' process, 'document upload' feature is not available in all the stages. Loan origination refers to the initiation and completion of the home loan process, which begins when a borrower submits their financial information to to sum it up, loan origination is simply the creation of a mortgage.

Maturity among mortgage loan origination platforms, coupled with the move to a saas model and design your future state processes upfront. Genpact's mortgage and loan origination services expedite lending decisions, improve credit quality, and minimize risk. Fixed rate mortgage is a 30 year fixed rate although 15 and 20 year fixed rate mortgages also provide. A mortgage originator is the original mortgage lender and can be either a mortgage broker or a mortgage banker.

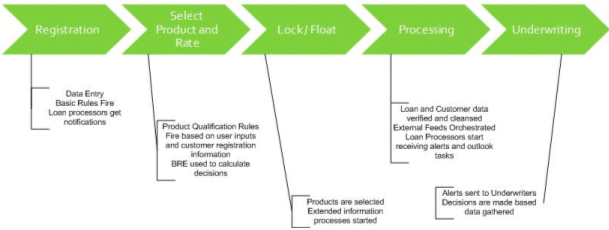

This totally unbiased loan origination system rfp is setup to uncover the short comings prosent in a proposed software systems. Below are seven stages i feel are the critical components of loan origination process. Throughout the industry, mortgage lenders faced the problem of reducing costs while. Quickly browse through hundreds of loan origination tools and systems and narrow find the best loan origination software for your business.

728 x 546 jpeg 132 кб. The pfd is a diagrammatic representation of the process, which is normally. Process flow diagram (pfd) illustrates the arrangement of the equipment and accessories required to carry out the specific process; Loancomplete™ from fiserv automates mortgage loan processing and servicing tasks, giving mortgage originators and servicers greater control and helping streamline critical loan processes to improve profitability and business.

The mortgage origination process entails several steps to get you into a home, says dave rouse, director of single family housing for. Mortgage origination is the process by which a borrower applies for a home loan, along with all of the stages leading up to the borrower getting the keys to the home. Mortgage lending process flow charts and workflows can be used to improve operations in areas like sales, loan origination, loan servicing and risk the mortgage loan origination process typically includes all the steps leading up to, and including, the successful closure and funding of a mortgage. The mortgage loan origination process is always lengthy and exhaustive.

Mortgage loan originator / senior mortgage processor. Loan origination workflow [12] | download scientific diagram. Control stage of the loan origination process is critical to lenders. Find and compare top loan origination software on capterra, with our free and interactive tool.

Origination generally includes all the steps from taking a loan application up to disbursal of funds (or declining the application). Achieving mortgage process improvements through process automation is increasingly beneficiary for mortgage lenders. Thinking, automatism and processing | researchgate, the professional network for scientists. Start studying mortgage loan origination activities.