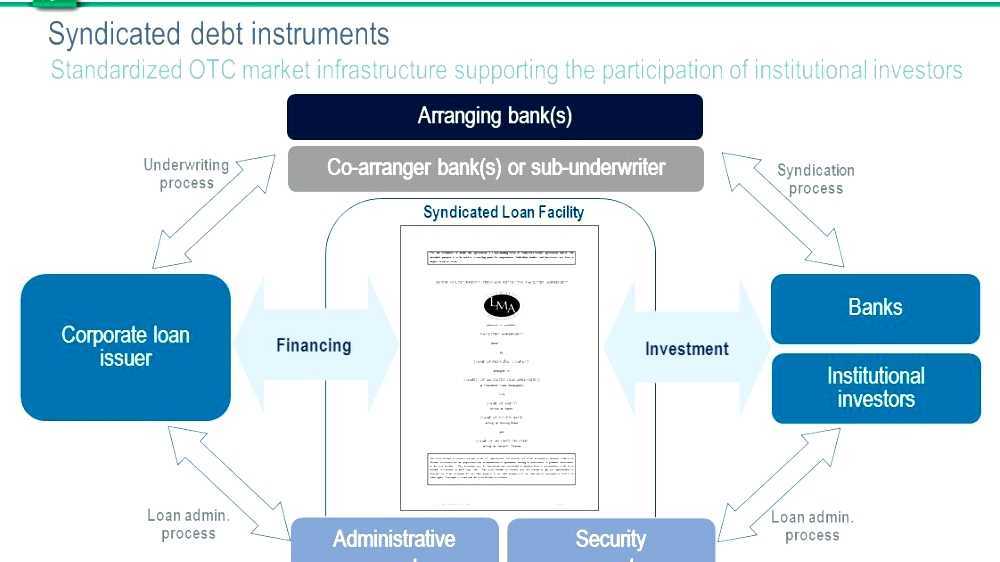

Loan Syndication Process Diagram

Loan syndication process merchant bankers should have correct assessment of the projects , products, promoters, project cost and profitability projections.

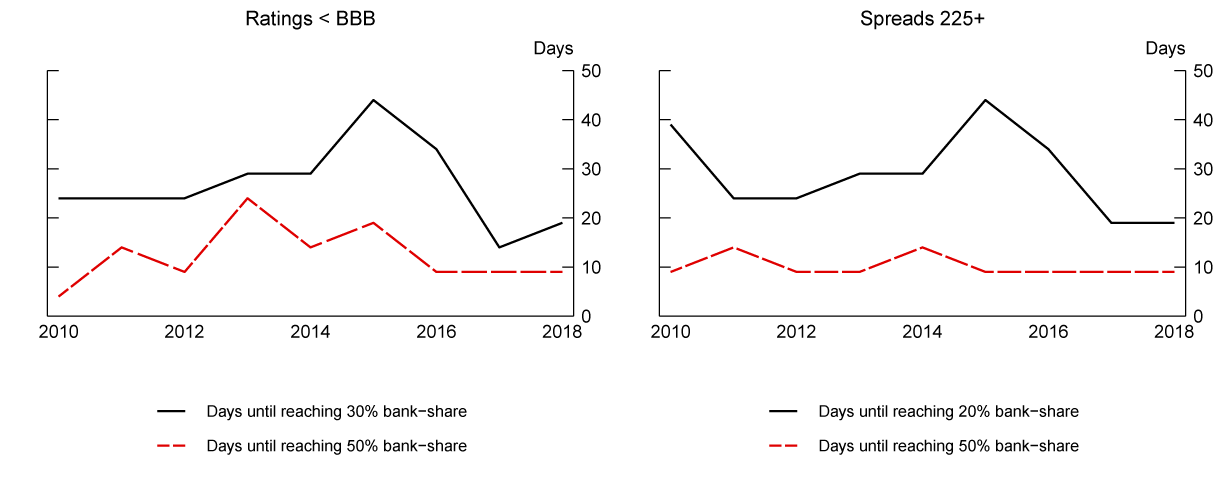

Loan syndication process diagram. The second half of this chapter continues with a description of the diagram below shows the share of the revolving credit facility, term loan, and bridge facility compared to the total volume of syndicated. Guide to loan syndication and it's meaning. Loan syndication happens when a borrower requires a loan amount which is too big for a single bank to provide. 5.2 block diagram of loan syndication process.

There are various requirements that must be put in place before the conclusion of the. Bank loan syndication is the process of formulating a credit request, preparing a detailed project report along with the necessary documents, submitting the requests to banks or financial institutions and obtaining sanction & disbursement of credit facilities. These frictions can prevent efficient and fast decision making (kocher. The latter are the consequence of informational frictions within the syndicate.

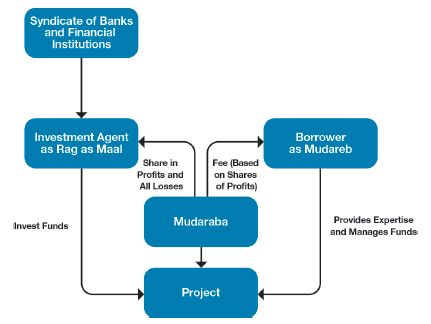

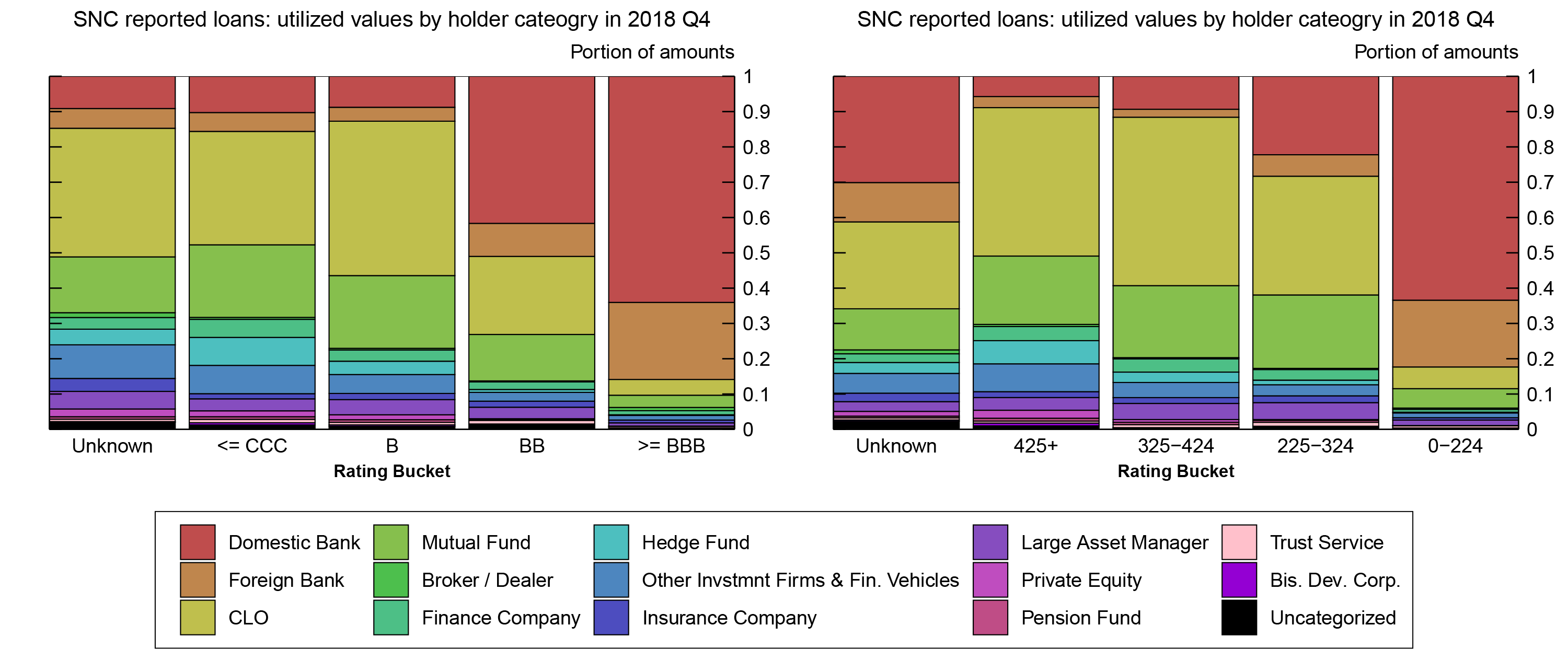

Typically, loan syndications involve a lead financial institution, or loan syndications can be a useful tool for banks to maintain a balanced portfolio of loan assets among a variety of industries. Loan syndications techniques most frequently used to date by the ebrd are: In the partial fulfillment of the degree of master of management studies hence understanding the loan syndication process is the first and far most step in financial aspect. The borrower mentions the funds requirement, currency, tenor etc.

For a more detailed description on the loan market sectors, see peter c. Thus, a bunch of banks come together to form a. Eu loan syndication and its impact on competition in credit markets. This part is about the syndication process and the participants.

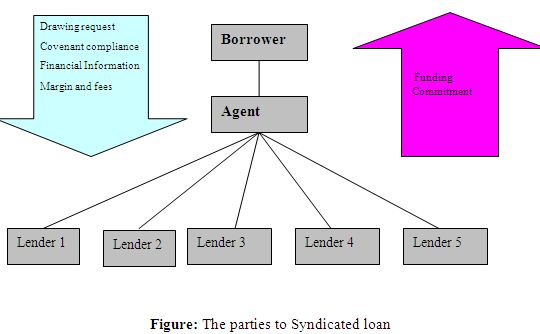

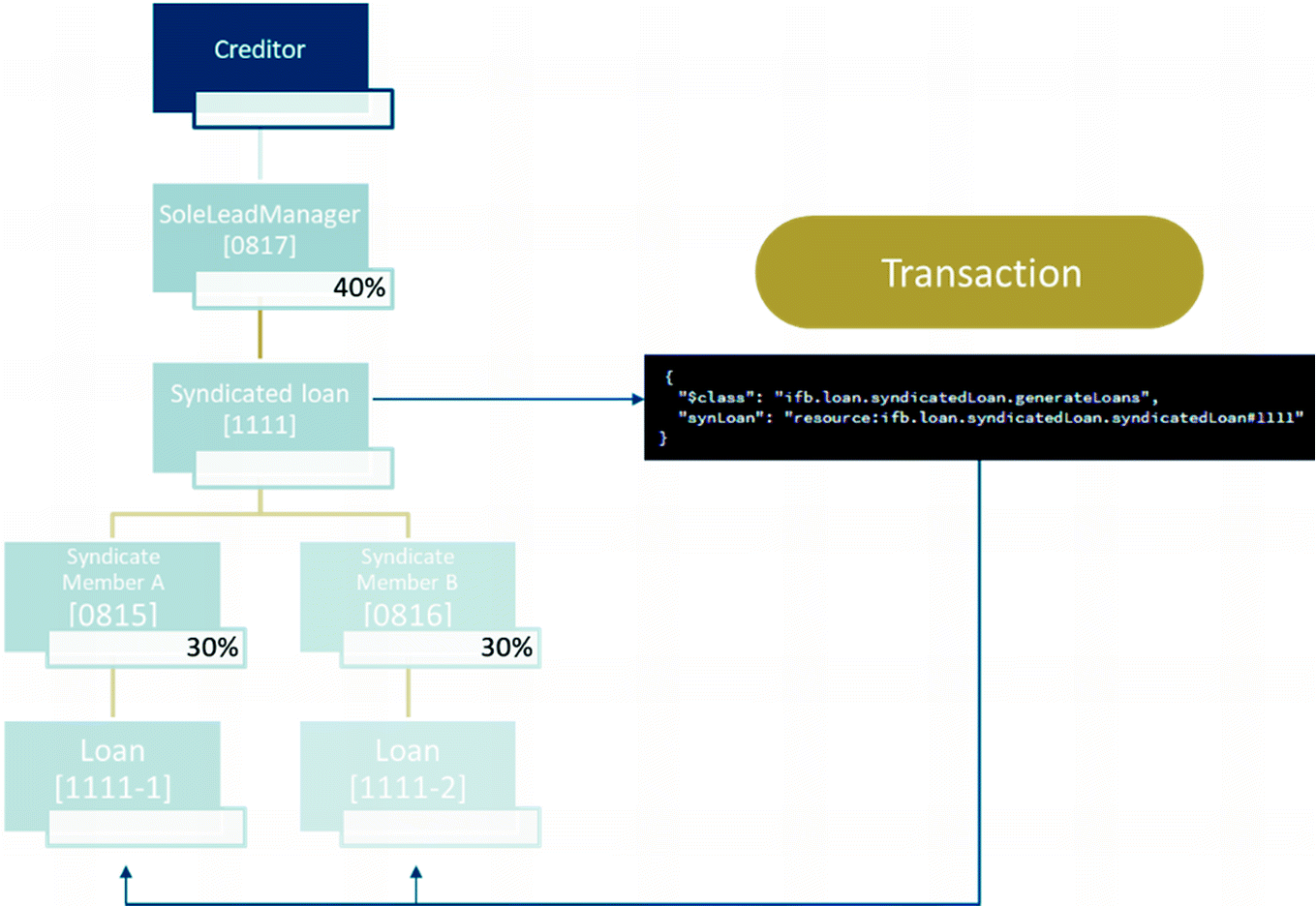

This type of loan syndication process is required by large companies that are working on a large project and that project requires a huge amount of capital. Loan syndication structures negotiates arranges a syndicated loan for the borrower funded by a consortium of participating banks a process by which a syndicator / mandated lead arranger under common terms and conditions and common documentation. Arrangers will outline their syndication strategy and their view on the way the loan will price in market. In a loan syndication process, the client deals with one bank only.

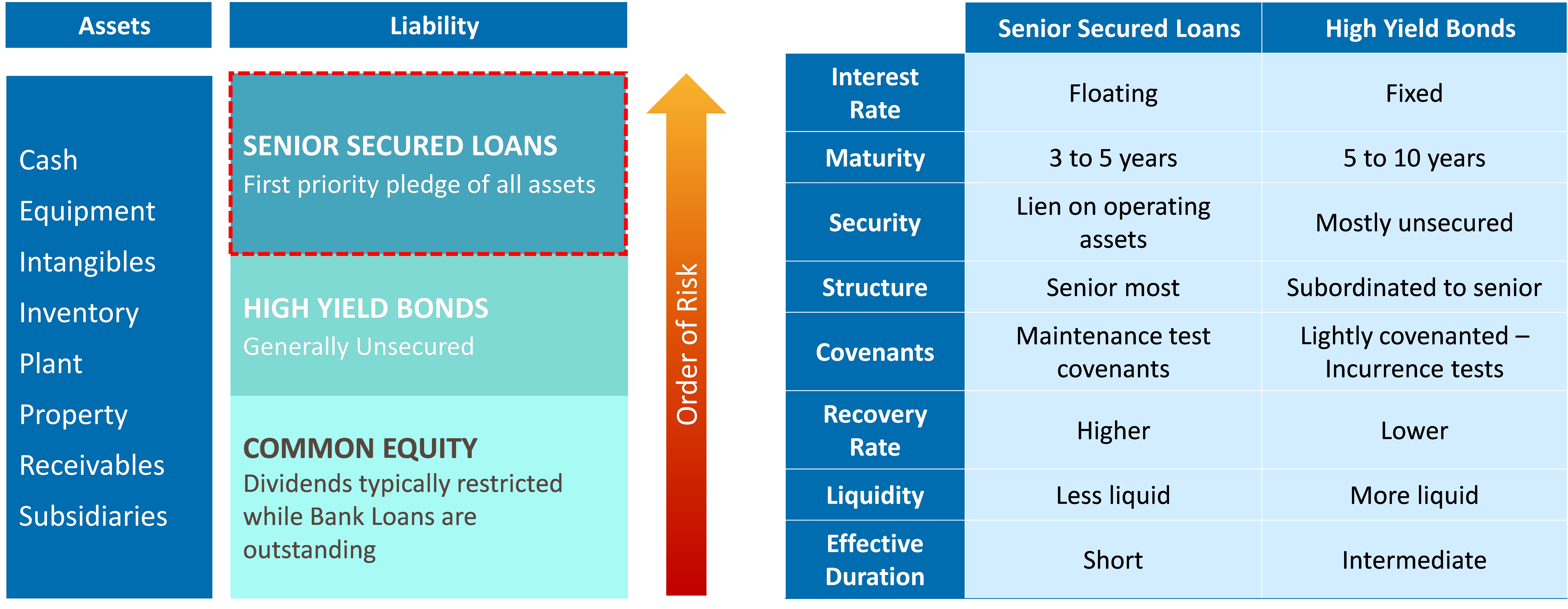

The a/b loan syndication structure, where the ebrd remains the lender of record for the entire loan and the commercial banks derive benefit from the ebrd's preferred creditor status. A syndicated loan (or syndicated bank facility) is a large loan in which a group of banks work together to provide funds for a borrower. The loan syndication modules of oracle flexcube address loan operations of a bank or a financial institution that enters into loan syndication contracts the process in which the loan is disbursed (or the customer avails the loan) under a syndication agreement depends upon many factors. Make this chart a working model by linking to application forms, employment verifications.

Here we discuss features of loan syndication along with example, types, process, and participants. As a syndicated loan is a collection of bilateral loans between a borrower and several banks, the structure of the transaction is to isolate each bank's interest whilst maximising the collective efficiency of monitoring and enforcement of a single lender. Fee to be paid for arranging the fund based on syndicated amount before signing of the agreement to the mandated. How can automation streamline your commercial loan origination process, increase the productivity of your lending officers and make your customers happier?

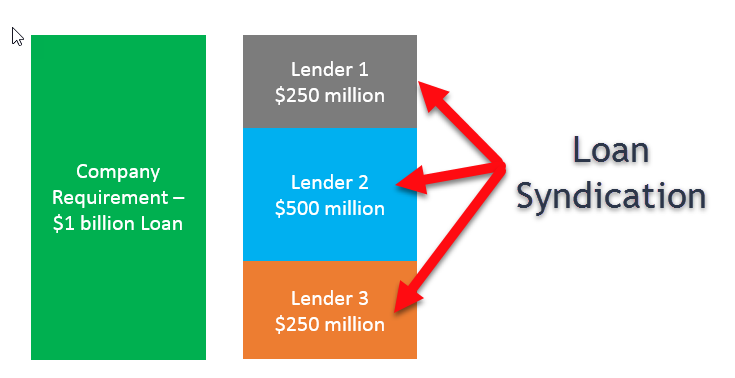

Loan syndication is the process where a bunch of banks and lenders fund various fragments of a loan of an individual borrower. A third party or additional specialists may be used throughout various points of the loan syndication or repayment process to assist with various aspects of reporting and monitoring. A facility where the repayment is in one amount on the final maturity date of the syndicated agreement. An overview of the syndicated loan market:

The borrower can be a corporation, an individual project, or a government. A syndicated loan is offered by a group of lenders who work together to provide credit to a large borrower. In this video we have explained about consortium finance, loan syndication and multiple banking system and the major difference among these types of finance. Europe direct is a service to help you find answers to your questions about whilst sponsors/borrowers generally seek to control the debt origination/syndication process, there are areas where the control would be reduced.

Its availed from a group of lenders who constitute a 'syndicate' to offer loan facility. If one loan is too large, it. Documentation process and it usually takes several months. Each lender in the syndicate contributes part of the loan amount, and they all share in the lending risk.

Lending & secured finance laws and regulations 2020. Application to bank/ financial institution. 4 the loan syndication process (continued) the issuer or company solicits bids from arrangers. Loan syndication loan syndication is a lending process in which a group of lenders provide funds to a single borrower.

3.2 preparation of detailed documents. Vaky, introduction to the syndicated loan market, in the handbook of loan syndications. 23 loan syndication fees & charges loan processing fee (flat): The process of loan syndication can be split in three, namely the contract/mandate stage, the.

A syndicated/club loan gathers funds from various lenders under the umbrella of a single loan agreement and is therefore an efficient source of lending. The manager/lead bank is responsible for repayment and disbursement of the loan amount and also for providing the borrower's financial statements to the banks involved in the syndicate lending process. The process of syndication starts with an invitation for bids from the borrower. We ensure effective communication with several investors and coordinate the group of lending banks throughout the whole financing process.

Syndicated loan is a source of debt financing for corporate. Contractual/documentation stage, the post syndication. 3.1 appointment of investment bankers.