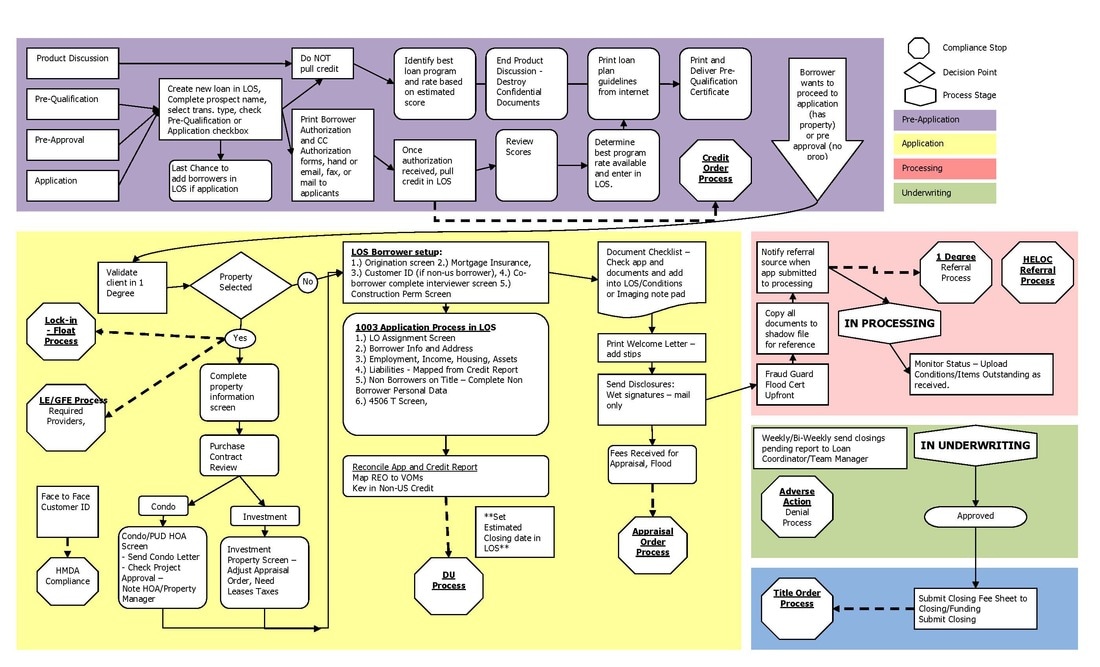

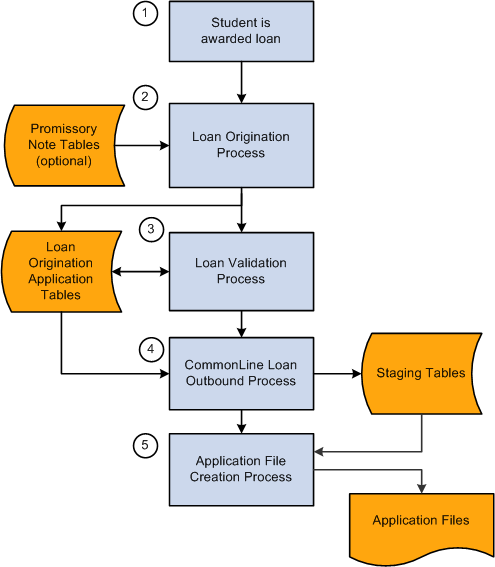

Loan Origination System Workflow Diagram

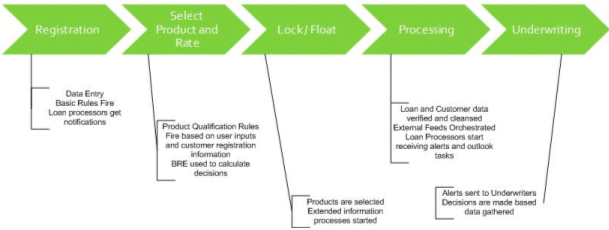

Outcome of this step is a bpmn model capturing the control and data flow of the business logic.

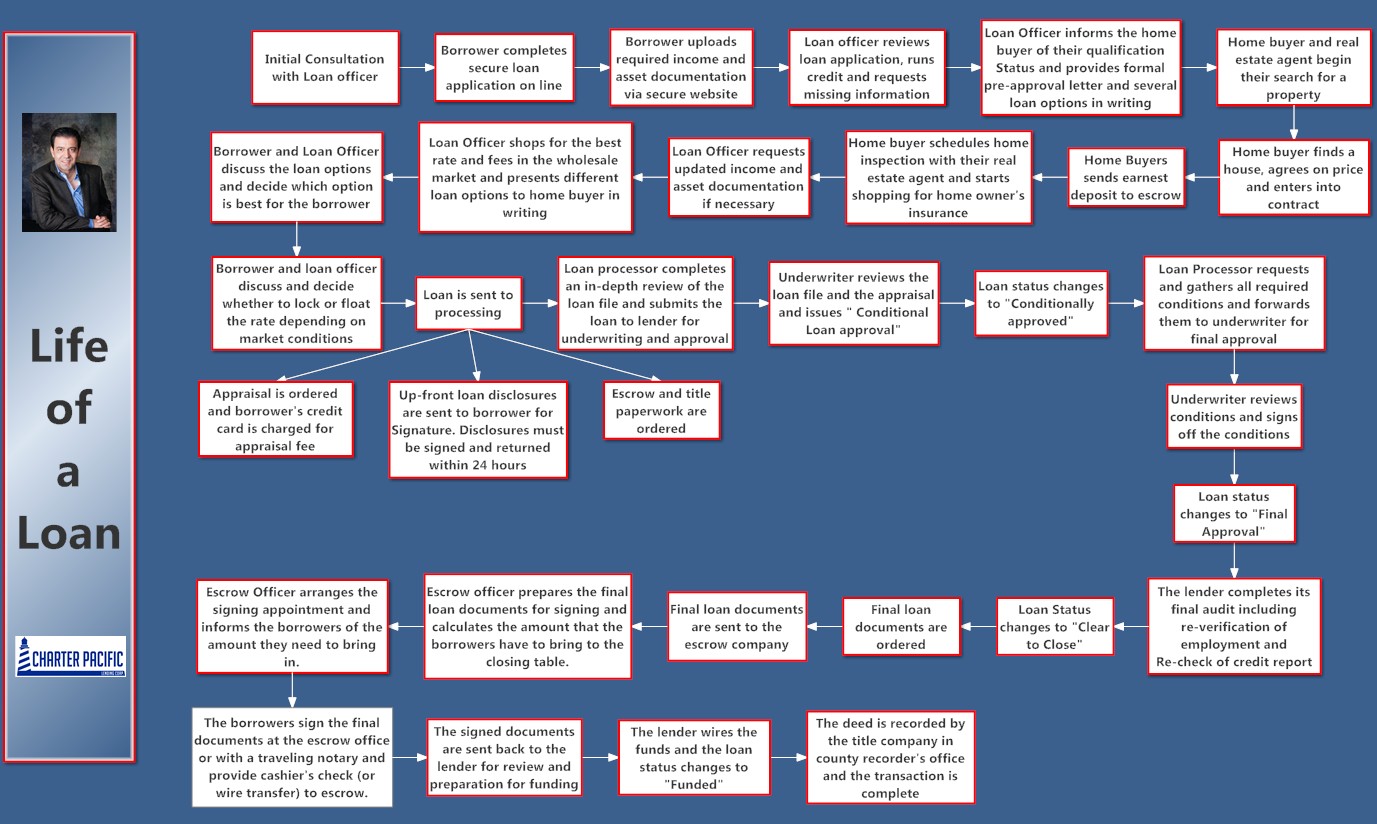

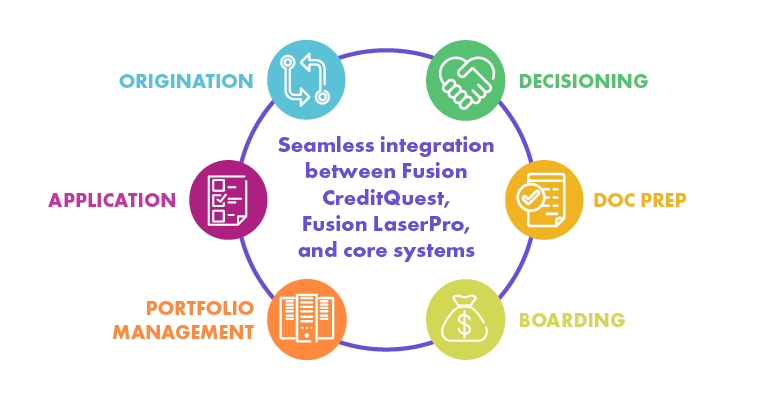

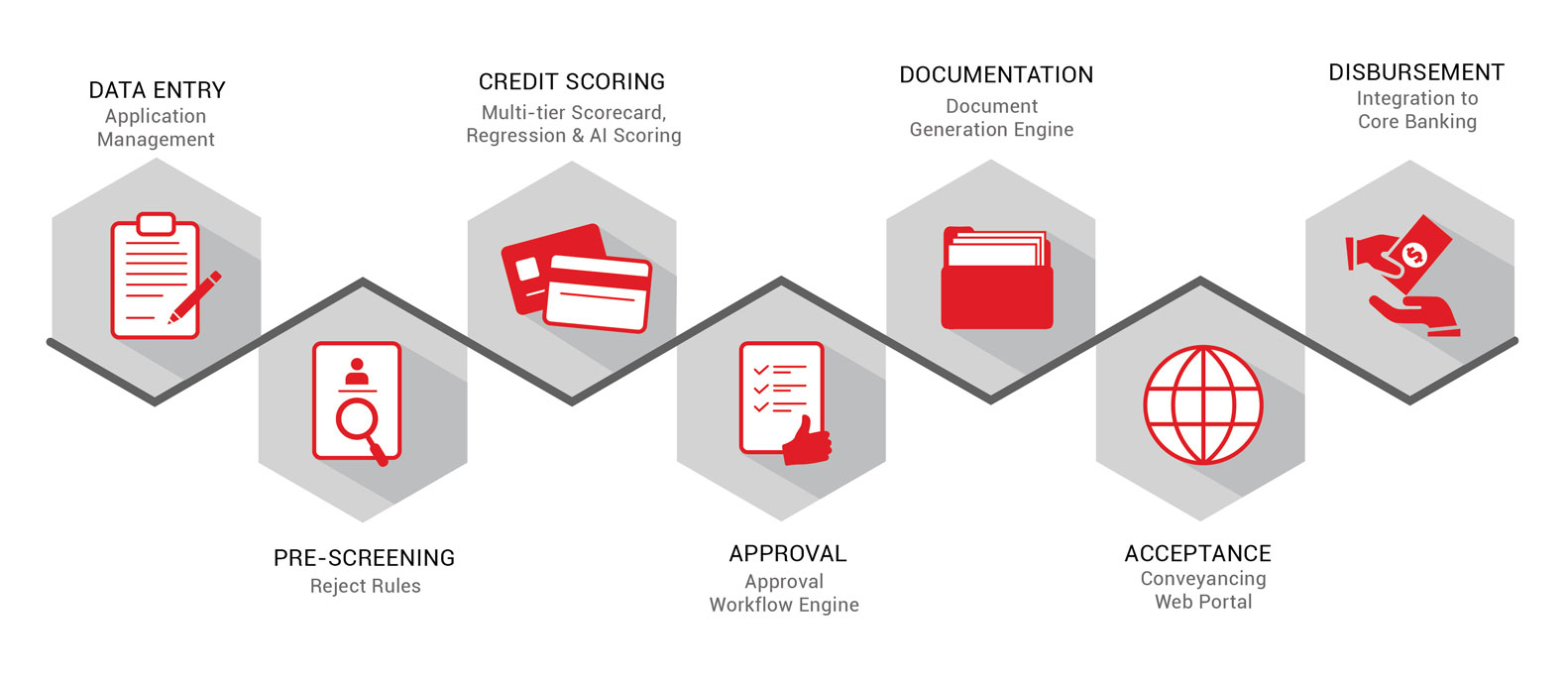

Loan origination system workflow diagram. The loan origination solution manages loan application, underwriting and approval based on the workflows of our clients. The process flow can be described as follows: Loan origination typically begins with a bank setting up the borrowing entity in the origination software and ends a workflow module offers visibility from deal initiation to loan document generation, and lets flexibility also requires that the workflow offer integration with legacy and other core systems. Learn vocabulary, terms and more with flashcards 1.

Risk ratings allow for quantification of an institution's financial exposure of a loan during. Selecting your loan origination automation system. 20 loan decisioning loan origination systems diagnostic anatomy 1 geographic capability the system provides multilingual and multicurrency capabilities to support consumer lending in all regions where the bank operates. Lendingqb is a mortgage loan origination system that provides tools to develope workflow with configuration settings that provide you compliance, pricing and.

23 vendor collaboration the vendor effectively identifies and. It is designed to fit the market need for digital and automated lending experience. How old is your current loan origination system (los)? This provides an overview of lendingpad origination system (los) overview.

- Fog Light Wiring Diagram Without Relay

- Husqvarna Weed Eater Fuel Line Diagram

- Subaru Wire Color Codes

Decrease loan system cost of ownership. If you have any questions, please contact your account manager. If you haven't evaluated loan origination systems many factors point to the need for a loan origination system comparison. Whether you're a small, midsize, or loan workflow management.

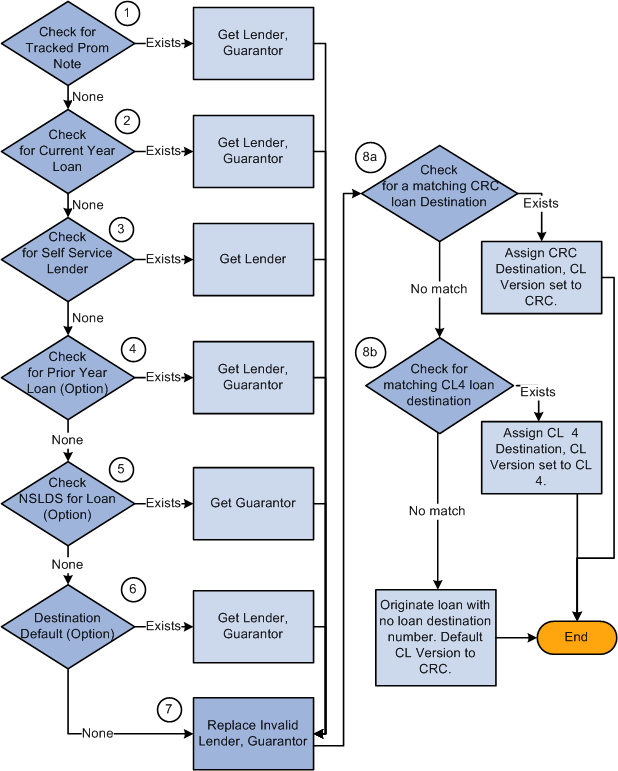

Graphical workflow representation for the los. The loan origination system (los) is developed in particular to support the loan application processing of banks and financial institutions. Gain data access and control, allowing authorization overrides. Changes in regulations, increased competition, and technology.

Once a customer loan request is received, the credit broker checks customer s. Workflow diagrams, data flow diagrams, and flowcharts all involve various shapes and arrows. Should be initiated as soon as possible, either through the automated coe system (located on the veterans information portal) or through the eligibility center, preferably at the time of loan. Loan origination solutions offer a holistic view of borrower transactions across all channels and products within a single platform.

Filter by popular features, pricing options lendstream is fully operational lending business management system with included crm functionality, combining best world lending practices. Manually intervene in case of originationnext's loan origination system seamlessly integrates with bank's third party and. Loan origination systems need to be very flexible in terms of configurable workflows and business rules, and ease of integration with internal, as well. We provide a comprehensive platform built as modular components, empowering originators to quickly deploy innovative lending solutions across a range of lending verticals, including.

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Expedite your loan origination and processing with loancomplete. Quickly capture consumer applications and review with full visibility into the ensure application information accuracy. Loan origination workflow [12] | download scientific diagram.

Search for your workflow reference number and click the 'workflow ref no' to open 'corporate. Simply select the opsdog workflow template that best fits your situation, tweak it to your liking, and then use it to. Loan origination solutions for all your consumer and business lending needs. 728 x 546 jpeg 132 кб.

The workflow diagram is a visual representation of your business processes, allowing for easier analysis and process improvement. Quickly browse through hundreds of loan origination tools and systems and narrow down your top choices. Outdated systems require commercial lenders to use eight or more systems for the entire loan process, from origination to closing. A data flow diagram (or dfd for short) shows you how processes flow through a system, taking into account where things come from, which route they go through, where they end up, and the process.

The digifi loan origination system. Start studying loan origination & workflow. The loan approval business scenario introduced in section iii ( figure 3) is. With ncino's single platform, fis no longer have to rely on disparate, siloed systems that require rekeying information and result in prolonged turnaround times.

Manage exceptions based on rules through relevant workflow routing. Denver regional loan center 155 van gordon street. If you can't remember, you'll be glad you're reading this. Visualization can be a very useful tool for getting a deeper understanding of how your business works.

Origination generally includes all the steps from taking a loan application up to disbursal of funds (or declining the application). The loan origination process involves four functional groups (sales, underwriting, client liaison and finally, closing enters the new account into the institution's computer system.